Every three years, the Scheme actuary works out how much money is in the Scheme and how much money is needed to pay members’ pensions. This process is called an actuarial valuation. Our latest actuarial valuation was completed on 17 March 2025.

How the valuation works

While the Government guarantees your BCSSS pension benefits, we still review the Scheme’s finances every three years in a formal exercise known as an ‘actuarial valuation’. The Government Actuary's Department (GAD) carries out the valuation.

GAD calculates two key figures:

1. The Obligation Percentage: This shows how much our investments need to grow to pay all future pensions. At 31 March 2024, we needed a return of 0.5% a year below inflation.

2. The Buffer Percentage: This shows how much our investments need to grow to pay all pensions and return the investment reserve to the government in 2033. At 31 March 2024, we needed a return of 1.9% a year above inflation.

The lower the Obligation and Buffer Percentage, the stronger the financial position of the Scheme.

GAD also checks if these figures stay within the limits set in our rules. If they don't, we must consult with the government about potentially taking action to rebalance the Scheme. Since both figures fall within the limits, no consultation was triggered, and no actions were required following the completion of the valuation.

What this means for members

The result of the valuation is positive for members – the Scheme is in good financial health.

For example, the safest investments like UK government inflation-linked bonds provide returns approximately 0.5% a year above inflation (if inflation runs at 3% a year, inflation-linked bonds would provide a return of 3.5% a year). Our Scheme only needs returns of 0.5% a year below inflation to meet all its pension obligations.

So, in this example, even if the Scheme invested in very low risk assets we would have a comfortable cushion, ensuring we have more than enough money to pay everyone's pensions, both now and in the future.

There are also bonds issued by well-known companies, called 'investment grade' bonds. While these are not as safe as UK government bonds, they are still considered reliable investments. If we invested all our assets in these bonds, we should have enough money to pay all pensions and return the investment reserve to the government in 2033.

This also means that if the government accepts the Trustees’ request for equal treatment (you can read more about this in our last update here), we should have sufficient funds to make these additional pension payments to members that equal treatment would require.

How the Scheme invests

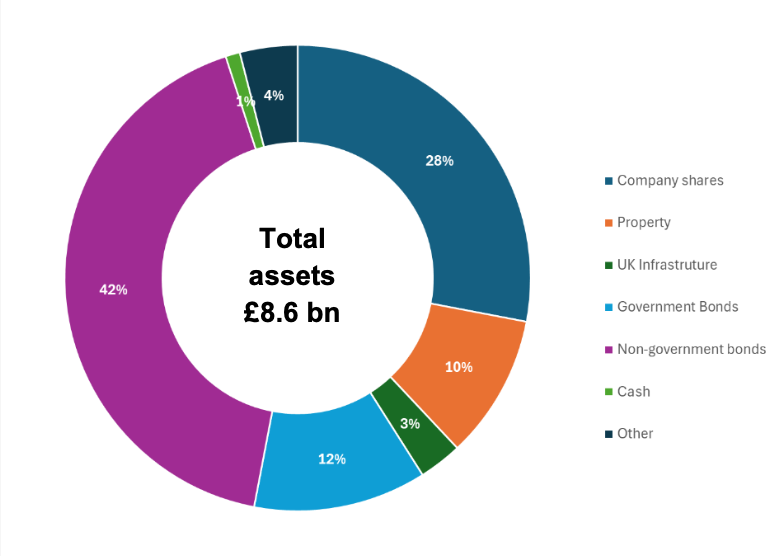

The Scheme takes a diversified approach, but bonds are an important part of the investment strategy – they provide regular income that the Scheme needs to meet the £600 million of annual pension payments.

At the valuation date the Scheme’s investment strategy was as follows:

As you can see, as well as investing in bonds, the Scheme also invests in company shares, property, and UK infrastructure, as well as holding some cash and other investments. More details on how the Scheme invests its assets can be found in the Annual Report and Accounts here, and the 2024 PensionsNews here.

Your pension is secure

Even if the investments don’t deliver, your pension is backed by a formal government guarantee. This means that even though we are currently in a period of high geopolitical and financial uncertainty, your BCSSS pension will always be paid.

The Trustees view the guarantee as a very important part of the Scheme’s structure, due to the security it provides members.

Get a copy of the valuation report

A copy of the valuation report is available on our Scheme Publications page.